Introduction

The Markets in Crypto-Assets Regulation (MiCA) introduces a comprehensive regulatory framework for crypto-assets within the European Union, aiming to enhance market integrity, financial stability, and consumer protection. This briefing document summarises the key themes and provisions outlined in the provided source document.

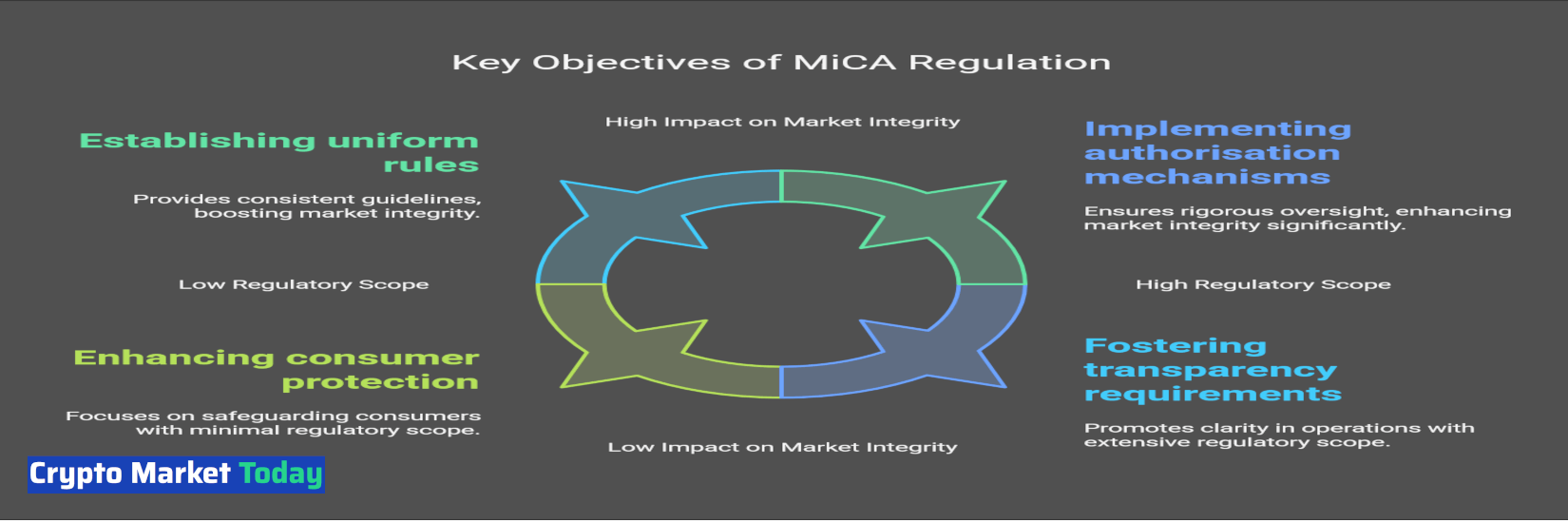

Key Objectives:

- Establish uniform rules for crypto-assets not covered by existing financial services legislation.

- Foster transparency and disclosure requirements for crypto-asset issuers and trading platforms.

- Implement authorisation and supervision mechanisms for crypto-asset activities.

- Enhance market integrity and financial stability.

- Improve consumer protection by mitigating risks associated with crypto-assets.

Implementation Timeline and Process:

- Enactment: MiCA entered into force in June 2023.

- Transitional Phase: An 18-month transitional period exists, concluding in December 2024, during which Member States can implement transitional measures, including "grandfathering" existing crypto-asset service providers.

- Full Application: MiCA will be fully applicable from December 2024.

- Level 2 and Level 3 Measures: These detailed implementing measures will be developed and published sequentially in three consultation packages:

- Package 1: July 2023 (authorisation, governance, conflicts of interest, complaint handling).

- Package 2: October 2023 (remaining mandates with a 12-month deadline).

- Package 3: Q1 2024 (remaining mandates with an 18-month deadline).

- ESMA's Role: The European Securities and Markets Authority (ESMA), in collaboration with other EU authorities, is leading the development of technical standards and guidelines, engaging in public consultations, and promoting supervisory convergence among Member States.

Key Provisions and Focus Areas:

- Authorisation and Supervision: Crypto-asset service providers (CASPs) will require authorisation and will be subject to ongoing supervision by national competent authorities (NCAs).

- Transparency and Disclosure: Issuers of crypto-assets must publish detailed white papers outlining the project, risks, and underlying technology.

- Investor Protection: Measures are in place to safeguard investors, including rules on reverse solicitation, suitability of advice, and portfolio management services.

- Market Abuse: Provisions aim to prevent market manipulation and insider trading in crypto-asset markets.

- System Resilience and Security: Robust systems and security protocols are mandated to mitigate operational risks.

- Sustainability: MiCA considers sustainability factors, including environmental impact, in its regulatory framework.

- Transitional Measures: Options for Member States to manage the transition include:

- Grandfathering: Permitting existing crypto-asset service providers to continue operating until July 2026 or until they obtain MiCA authorisation.

- Simplified Authorisation: A streamlined process for entities already authorised under national law.

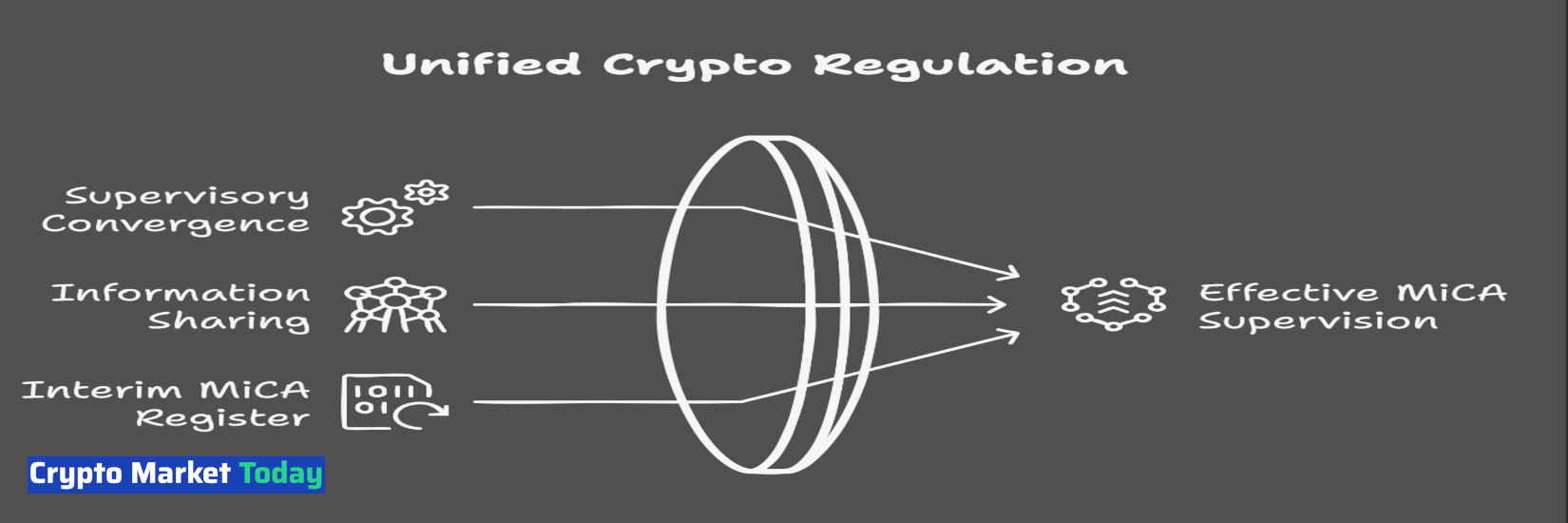

Supervisory Convergence and Information Sharing:

- ESMA actively promotes supervisory convergence among NCAs to ensure consistent application of MiCA across the EU.

- Information-sharing mechanisms are established between NCAs, ESAs, and third countries to facilitate effective supervision.

- ESMA is developing an interim MiCA register to be published by December 2024, containing information on authorised CASPs, crypto-asset white papers, and non-compliant entities.

Quote: "The new legal framework will support market integrity and financial stability by regulating public offers of crypto-assets and by ensuring consumers are better informed about their associated risks."

MiCA Regulation FAQ

1. What is the Markets in Crypto-Assets Regulation (MiCA)?

MiCA is a new set of regulations created by the European Union (EU) to govern the crypto-asset market. It aims to harmonise regulations across all EU member states, improve market integrity and financial stability, and provide greater protection for consumers. MiCA covers a range of crypto-asset activities, including issuance, trading, and the provision of crypto-asset services.

2. When will MiCA come into effect?

MiCA entered into force in June 2023. However, full application of the regulations is expected in December 2024, following an 18-month implementation phase during which a number of Level 2 and Level 3 measures are being developed and consulted on.

3. What is the purpose of the MiCA consultation process?

The consultation process aims to gather feedback from the public and industry stakeholders on the draft technical standards and guidelines that will underpin MiCA. This feedback will be used to refine the measures and ensure they are practical, effective, and reflect the diverse perspectives within the crypto-asset ecosystem.

4. How is the MiCA consultation process structured?

ESMA (European Securities and Markets Authority) is leading the consultation process, in collaboration with other EU regulatory bodies. The process is being conducted in three sequential consultation packages, each focusing on different aspects of MiCA. The first package was launched in July 2023, the second is expected in October 2023, and the third in Q1 2024.

5. What are the transitional measures for existing crypto-asset service providers?

MiCA includes transitional measures to allow existing crypto-asset service providers operating under national laws to continue their activities during the implementation phase. This includes a 'grandfathering' clause (Art. 143 (3)) which allows continued operation until July 2026 or until a MiCA authorisation is granted or refused, and a simplified authorisation procedure (Art. 143 (6)) for already authorised entities.

6. How is ESMA promoting supervisory convergence during the transitional phase?

ESMA is working with national competent authorities (NCAs) to ensure a consistent approach to authorisations and supervision of crypto-asset service providers (CASPs) during the transitional phase. This includes providing a forum for NCAs to share best practices, mapping the existing landscape of CASPs, and engaging with the Commission to clarify any ambiguities in the MiCA provisions.

7. What is the purpose of the interim MiCA register?

The interim MiCA register is a publicly accessible database that will eventually list all authorised CASPs, crypto-asset white papers, and non-compliant entities. It is being developed by ESMA and will be updated monthly. This register aims to provide transparency and help stakeholders understand the regulatory landscape for crypto-assets in the EU.

8. Where can I find more information about MiCA and the ongoing consultation process?

Detailed information on MiCA, the consultation packages, the interim MiCA register, and other relevant documents can be found on the ESMA website. You can also stay informed by subscribing to ESMA's newsletter and following their social media channels

Conclusion

MiCA represents a significant step in regulating the crypto-asset market within the EU, aiming to strike a balance between fostering innovation and protecting investors and the financial system. The phased implementation, detailed technical standards, and emphasis on supervisory convergence demonstrate a comprehensive approach to address the unique challenges posed by crypto-assets. The success of MiCA will depend on effective implementation, ongoing monitoring, and adaptation to the evolving nature of the crypto-asset landscape.