London, 2024 — Mention “blockchain” in a British pub and you will usually be met with two reactions: a polite nod from the tech-savvy regular and a blank stare from everyone else. Yet the technology is already woven into everyday life for millions of Britons who buy, sell or hold cryptocurrency. From Bitcoin purchased on Freetrade to non-fungible tokens auctioned at Christie’s, every transaction is underpinned by a single invention: the blockchain. This article strips away the jargon and explains, in plain English, how the system actually works—and why it matters to UK consumers.

What is a blockchain?

Imagine a hard-backed notebook placed in the middle of Trafalgar Square. Anyone may read earlier pages; no one may tear them out; fresh pages are added only when two-thirds of the crowd agree the new entries are honest. Once a page is glued in, the adhesive hardens for good. That notebook is, in essence, a blockchain: a public, digital ledger duplicated across thousands of computers (nodes) so that no single person controls the record. Each page is a “block”; the glue is cryptographic maths; the crowd is the network.

Why this matters for crypto?

Cryptocurrencies have no High Street branch, no call-centre and no ombudsman. Trust is instead derived from the ledger’s immutability. Because every transaction is time-stamped and visible, a Liverpool student can send £20 worth of Bitcoin to a friend in Glasgow at 2 a.m. without involving Barclays, PayPal or the Bank of England. The blockchain replaces the intermediary with code, cutting fees and, in theory, reducing fraud.

How blockchain works, step by step

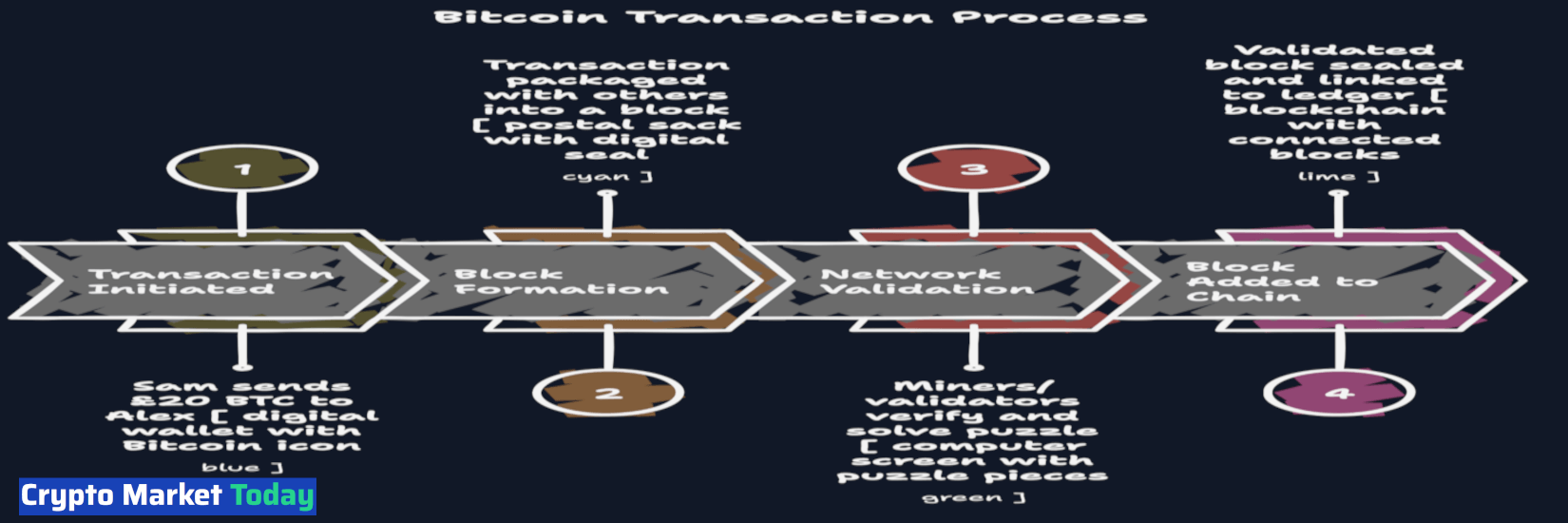

1. A transaction happens

Sam opens her Bitcoin wallet and transfers £20 of BTC to Alex. She signs the transaction with her private key—a secret digital signature—and presses “send”.

2. Transactions enter a ‘block’

Within seconds her instruction, along with hundreds of others, is packaged into a digital container called a block. Think of it as a postal sack waiting to be cleared.

3. The network validates it

Miners (on Bitcoin) or validators (on newer networks such as Ethereum 2.0) race to check the sack’s contents. They confirm Sam really owns the £20 and that she has not already spent it. In proof-of-work systems, miners solve a fiendish numerical puzzle; the first to succeed broadcasts the solution. In proof-of-stake systems, validators put up a financial bond and are chosen by lottery. Either way, consensus is reached without a central umpire.

4. The block is added to the chain

Once validated, the sack is sealed with a tamper-proof label—its cryptographic hash—and linked to the previous sack. Every node updates its copy of the ledger. Sam’s £20 now belongs to Alex, permanently and transparently.

Why blockchain is so secure?

Decentralisation: The ledger is stored on computers from Cornwall to Kolkata. To destroy it, you would need to wipe every copy simultaneously.

Cryptographic fingerprints: Each block contains a hash, a string of characters unique to its data. Alter even a comma and the hash changes, alerting the network.

No single point of failure: Because control is dispersed, there is no Fort Knox to raid.

Analogy: Picture a leather-bound council ledger kept in 10,000 village halls. If a miscreant tippexes one entry, the mismatch is obvious when the village clerk compares her copy with neighbours. The bad ledger is ignored.

Real-world examples (UK edition)

- Bitcoin transfers: A freelance designer in Bristol invoices a Tokyo client and receives BTC within 20 minutes, sidestepping the £25 fee her bank would levy on SWIFT.

- Smart contracts on Ethereum: A vending-machine contract releases tickets for the 2025 Champions League final only when payment arrives, removing the need for a ticket agency.

- NFTs: Digital artist Ben Gentilli sold “Portrait of a Mind” at Christie’s London for more than £10 million; ownership is provable because the token is on the blockchain.

- Future government uses: The Department for Work and Pensions has trialled blockchain to let benefit claimants manage digital identities, potentially slashing paperwork.

Common mistakes to avoid

- “Blockchain equals Bitcoin.” No—blockchain is the railway track; Bitcoin is merely one train.

- “All blockchains are identical.” They are not. Solana processes 65,000 transactions per second; Bitcoin manages seven.

- “Blockchain is hack-proof.” It is highly secure, but coding errors in smart contracts can be exploited. The 2022 Ronin bridge hack, where £480 million vanished, proves the point.

- “Transactions are free.” They are not. Sending Ethereum during peak hours can cost more than a Heathrow Express ticket.

Conclusion

Blockchain is neither sorcery nor Silicon Valley marketing fluff. It is a method—elegant in its simplicity—of keeping trustworthy records without a central custodian. For UK consumers, that translates into faster remittances, transparent provenance for digital art and, crucially, the confidence that when they buy cryptocurrency they are not simply gambling in the dark. Master the basics today and the next time the subject arises, whether in a Shoreditch café or a Glasgow taxi queue, you will be the one explaining the unexplainable—without breaking a sweat.

Next: Learn how to buy your first crypto safely →