Hey ! Welcome to our post on the world of crypto-assets and their regulations. I know, I know - it sounds like a snooze-fest, but bear with me, people! We're about to dive into some pretty interesting stuff.

As you might know, crypto-assets have been gaining traction in recent years. From Bitcoin to Ethereum, tokens, and more, these digital assets are changing the way we think about money and finance. But with great power comes great responsibility, right? That's where regulations come in.

Introduction

So, what's the big deal about regulating crypto-assets? Well, for starters, it's essential to have clear guidelines in place to ensure that these digital assets are used responsibly and don't fall prey to scams or other nefarious activities. Think of it like this: just as you wouldn't want your money to be handled by someone who doesn't know what they're doing, we need to make sure that crypto-assets are managed by people (and institutions) who understand the risks and benefits.

Regulations also help to protect investors, who might not always be aware of the potential risks associated with investing in crypto-assets. It's like buying a house - you want to make sure it's a solid investment, right? Regulations can provide that peace of mind.

Current State of Crypto-Asset Markets

Let's take a look at where we are today. The crypto-asset market has grown significantly since its inception, with over 3,700 actively traded assets (yes, you read that right - 3,700!) and more than 7,900 trading pairs. That's a lot of digital assets floating around out there!

Some popular ones include Bitcoin, Ethereum, Tether, and others like XRP and Solana. These assets have seen significant growth in recent months, with Bitcoin reaching an all-time high of $108k (yes, that's 108 thousand dollars!) and other altcoins following suit.

But here's the thing: this rapid growth has also led to increased volatility and market fluctuations. It's like a rollercoaster ride - you never know what's going to happen next!

Regulatory Challenges and Approaches

Now, let's talk about regulations. As we mentioned earlier, it's essential to have clear guidelines in place to ensure that crypto-assets are used responsibly. But here's the thing: different countries and regulatory bodies have taken different approaches.

Some have been more permissive (Singapore, Japan), while others have taken a more restrictive stance (China, India). And then there are those who've adopted a hybrid approach (US, EU).

The lack of clear definitions and classifications is also a challenge. What exactly constitutes a crypto-asset? Is it just Bitcoin and Ethereum, or are there other types of digital assets out there?

Key Regulatory Initiatives and Frameworks

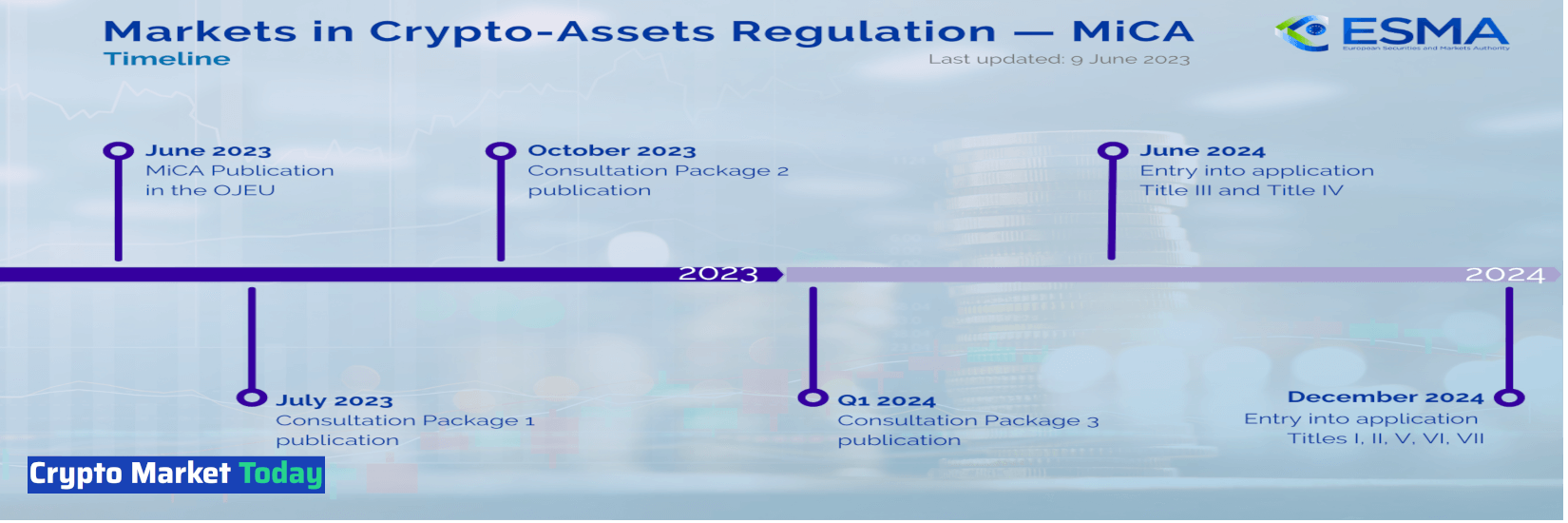

So, what's being done to regulate these digital assets? Well, for starters, the EU has introduced the Markets in Crypto-Assets (MiCA) regulation, which aims to provide a clear framework for crypto-assets.

The US Securities and Exchange Commission (SEC) has also issued guidance on digital assets, while the Financial Action Task Force (FATF) has recommended measures to combat money laundering and terrorist financing.

These initiatives are crucial in establishing trust and confidence in the crypto-asset market. By having clear guidelines in place, we can ensure that investors and financial institutions operate within a safe and regulated environment.

Implications for Investors and Financial Institutions

So, what does this mean for investors and financial institutions? Well, for starters, regulations will require increased transparency and disclosure requirements. This means that investors will need to be more informed about the potential risks and benefits associated with investing in crypto-assets.

Financial institutions will also need to develop new compliance and risk management frameworks to ensure they're operating within regulatory guidelines.

But here's the thing: these regulations can also create new business opportunities and revenue streams for financial institutions. It's like a double-edged sword - on one hand, you have increased risks; on the other hand, you have potential rewards!

Broader Economic and Social Implications

Now, let's talk about the broader implications of crypto-asset regulations. One thing to consider is the impact on financial inclusion and access to financial services.

Regulations can help ensure that these digital assets are used responsibly and don't fall prey to scams or other nefarious activities. This can lead to increased trust and confidence in the market, making it easier for people to access financial services.

However, regulations can also create barriers to entry for new players, which might limit innovation and growth in the market.

Conclusion (TLDR)

And there you have it - a brief overview of the world of crypto-assets and their regulations. It's a complex and evolving issue, but one that's essential for ensuring the responsible use of these digital assets.

As we move forward, it's crucial to have ongoing dialogue and collaboration between stakeholders to ensure that regulations are effective in protecting investors and financial institutions while also promoting innovation and growth in the market.

Thanks for sticking with me through this post! If you have any questions or comments, feel free to share them.