The History of Crypto: A Rich and Fascinating Story

In recent years, cryptocurrencies have become an increasingly important part of our financial landscape. From their humble beginnings in the 1980s to the present day, crypto has evolved into a diverse and complex ecosystem that continues to shape the way we think about money and finance.

As we look back on the history of crypto, it's clear that this journey has been marked by innovation, experimentation, and sometimes, chaos. From the early days of digital currency systems to the emergence of Bitcoin and beyond, the story of crypto is one of resilience and adaptability.

In this blog post, we'll take a comprehensive look at the history of crypto, from its precursors in the 1980s to the current state of the industry. We'll explore the key innovations that have driven the evolution of crypto, the challenges it has faced, and the opportunities that lie ahead.

The Early Days: Precursors to Cryptocurrencies (1980s-1990s)

The concept of digital currency dates back to the 1980s, when pioneers like David Chaum began experimenting with electronic cash systems. In 1983, Chaum founded DigiCash, a company that aimed to create a secure and anonymous form of online payment.

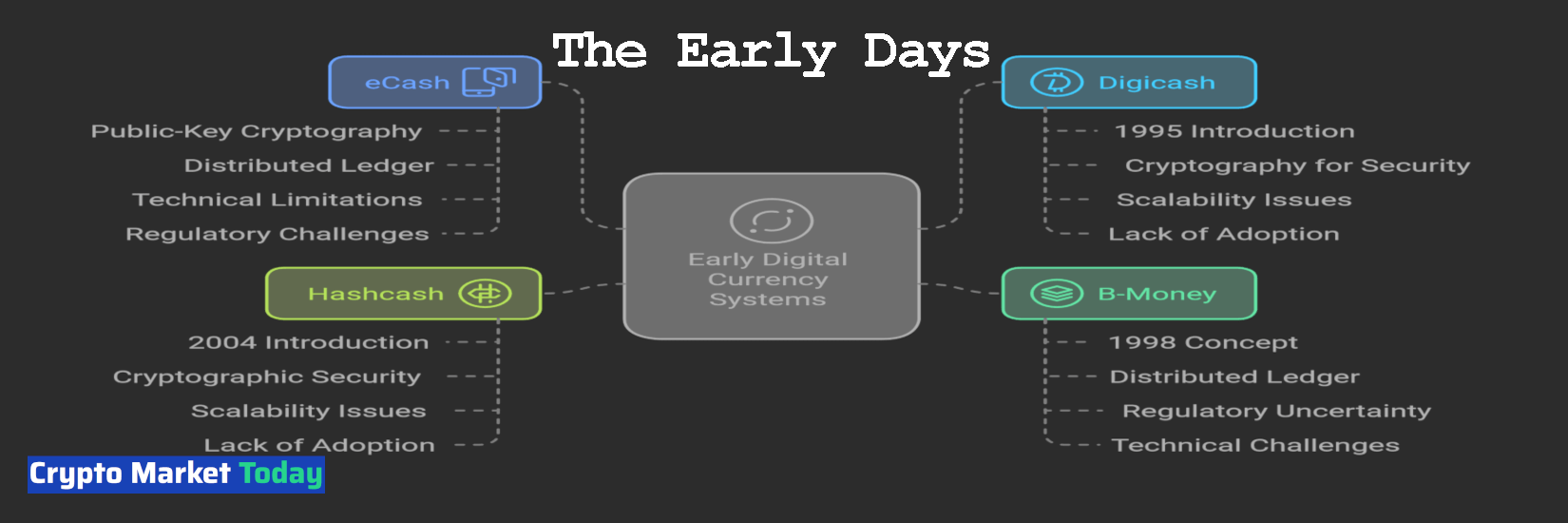

One of the earliest digital currency systems was ecash, which used a combination of public-key cryptography and a distributed ledger (similar to blockchain) to facilitate transactions. While eCash showed promise, it ultimately failed to gain traction due to technical limitations and regulatory challenges.

Other early attempts at creating digital currencies include Digicash (1995), B-Money (1998), and Hashcash (2004). These systems all shared similarities with modern cryptocurrencies, such as the use of cryptography for security and the creation of a distributed ledger for transaction verification. However, they also faced significant hurdles, including scalability issues, lack of adoption, and regulatory uncertainty.

The Birth of Bitcoin (2008)

In 2008, an individual or group using the pseudonym Satoshi Nakamoto published a whitepaper outlining the concept of Bitcoin. This groundbreaking document introduced the world to Blockchain technology, Decentralized peer-to-peer transactions, and Cryptographic security.

Bitcoin's innovative design allowed for secure and transparent transactions between parties without the need for intermediaries like banks. The use of a distributed ledger (blockchain) enabled a network of computers to verify and record transactions in real-time, ensuring the integrity and immutability of the data.

The early days of Bitcoin were marked by limited adoption and skepticism from the mainstream financial community. However, as the network grew and more users joined, Bitcoin began to gain traction. In 2010, the price of a single Bitcoin hovered around $0.08; just three years later, it had surged to over $1,000.

The Rise of Altcoins (2010-2014)

As Bitcoin's popularity grew, other digital currencies emerged in an effort to capitalize on its success. The first altcoin, Litecoin, was launched in 2011 by Charlie Lee, a former Google employee. Other notable altcoins from this era include Ethereum (2014), Dogecoin (2013), and Namecoin (2011).

Altcoins aimed to improve upon the design of Bitcoin or introduce new features that would differentiate them from their predecessor. However, many altcoins struggled with scalability issues, security concerns, and a lack of adoption.

The Era of Smart Contracts and ICOs (2015-2017)

In 2014, Ethereum launched its own blockchain platform, which introduced the concept of smart contracts to the world. smart contracts allowed for self-executing agreements that could be programmed to automate complex processes.

The rise of Initial Coin Offerings (ICOs) followed soon after, as companies began using Ethereum's platform to raise funds through token sales. ICOs offered a new way for businesses and entrepreneurs to access capital without traditional fundraising channels like venture capital or public offerings.

Notable Ico's from this era include the DAO (2016), which raised over $150 million in ether tokens, and Filecoin (2017), which aimed to create a decentralized storage network using smart contracts.

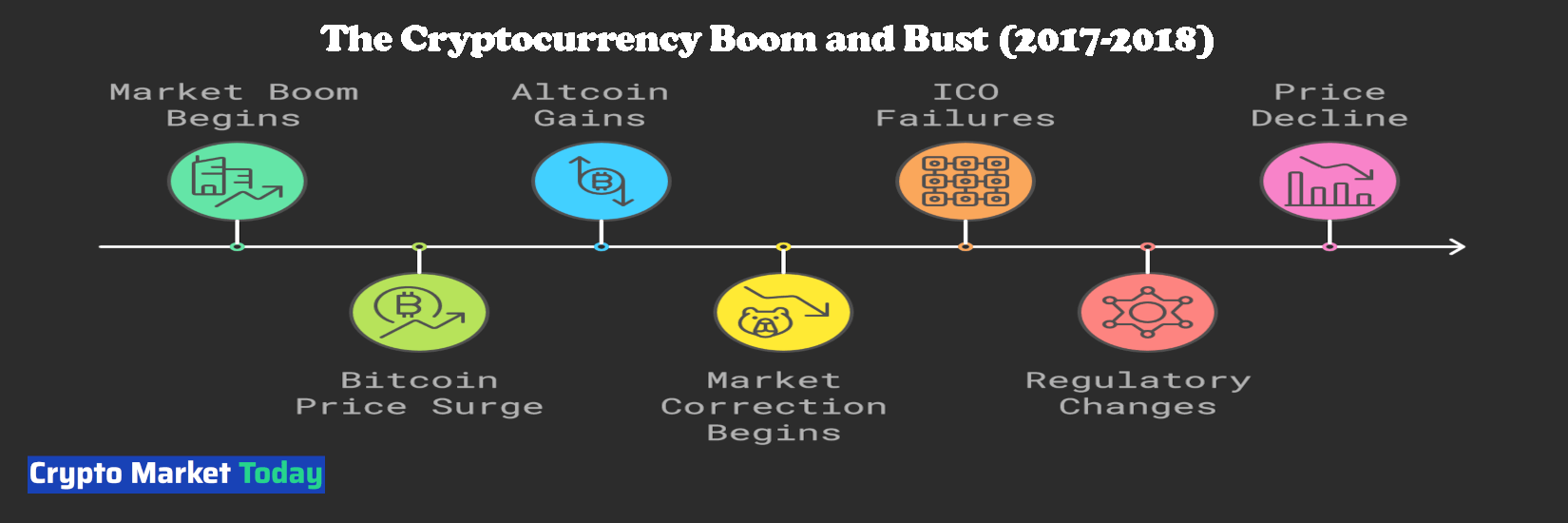

The Cryptocurrency Boom and Bust (2017-2018)

In 2017, the cryptocurrency market experienced an unpresidetial boom, with prices surging across the board. Bitcoin's price rose from around $1,000 in January to over $19,000 in December, while other altcoins saw even more spectacular gains.

However, this rapid growth was followed by a brutal correction, as the market crash in 2018. The collapse of several high-profile ICOs and the introduction of stricter regulations led to a sharp decline in cryptocurrency prices.

The Current State of Cryptocurrencies (2019-present)

Today, the cryptocurrency landscape is more diverse than ever before. We've seen the emergence of decentralized finance (DeFi) platforms, which have attracted millions of users and billions of dollars in capital.

Stablecoins like USDT and DAI have become increasingly popular, offering a way to hedge against price volatility and facilitate cross-border transactions.

Mainstream institutions are also starting to take notice of cryptocurrencies, with companies like PayPal and Square integrating them into their payment systems.

Conclusion

The history of crypto is one of innovation, experimentation, and adaptation. From its humble beginnings in the 1980s to the present day, this journey has been marked by resilience and a willingness to learn from mistakes.

As we look to the future, it's clear that cryptocurrencies will continue to play an important role in shaping the world of finance. While challenges remain, the opportunities for growth and adoption are vast.

Join us next time as we explore the latest developments in the world of crypto!